What is the Colorado Retail Delivery Fee?

Starting July 1, 2022, for stores that are located in the state of Colorado or remit taxes to Colorado, Colorado requires a $0.27 fee on all orders mailed or delivered to customers with a Colorado shipping address .

This fee applies to U.S. retailers selling tangible goods delivered by vehicle to Colorado consumers, whether the delivery originates in Colorado or in another state, and whether you own or operate the vehicle used to make the delivery.

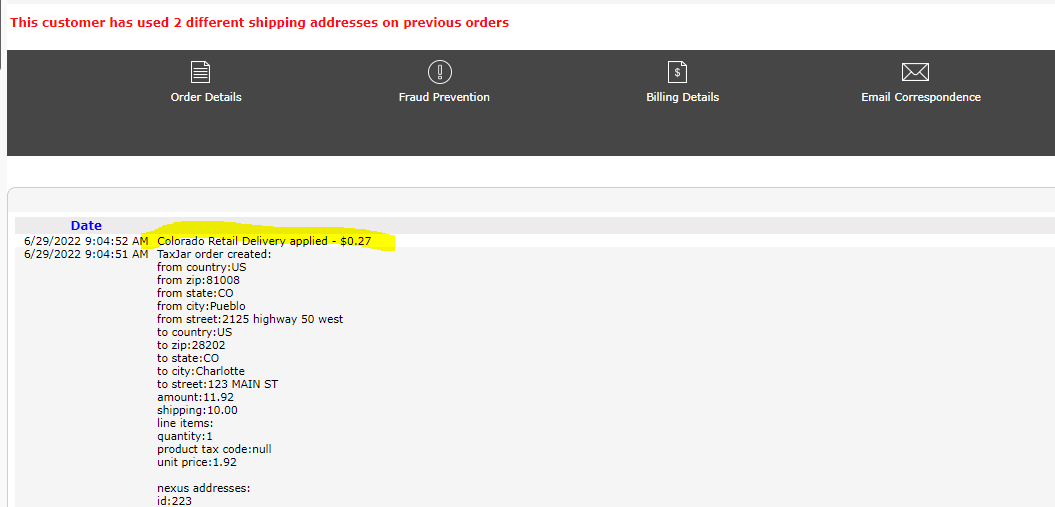

Your online store has the option to turn on a setting to automatically charge this fee to orders with a Colorado shipping address. Note this fee will not apply to orders marked as “local pick-up.” If the fee has been applied to an order, it will show in Order Notes as “Colorado Retail Delivery Fee applied to shipping.”

Please note that your business is responsible for the remittance of the taxes to the proper taxing authority. Should you have questions about your tax obligations regarding this fee, we suggest you reach out to your tax advisors.

If your business would like to opt into this fee, please fill out this form.

For more information about the Retail Delivery Fee, please visit the Colorado Department of Revenue’s website here.